A savings account is a hobby-bearing deposit account held at a monetary institution or specific monetary organization. Though those bills commonly pay a modest interest rate, their protection and reliability give them an incredible opportunity for parking cash, which you want available for a short-term period.

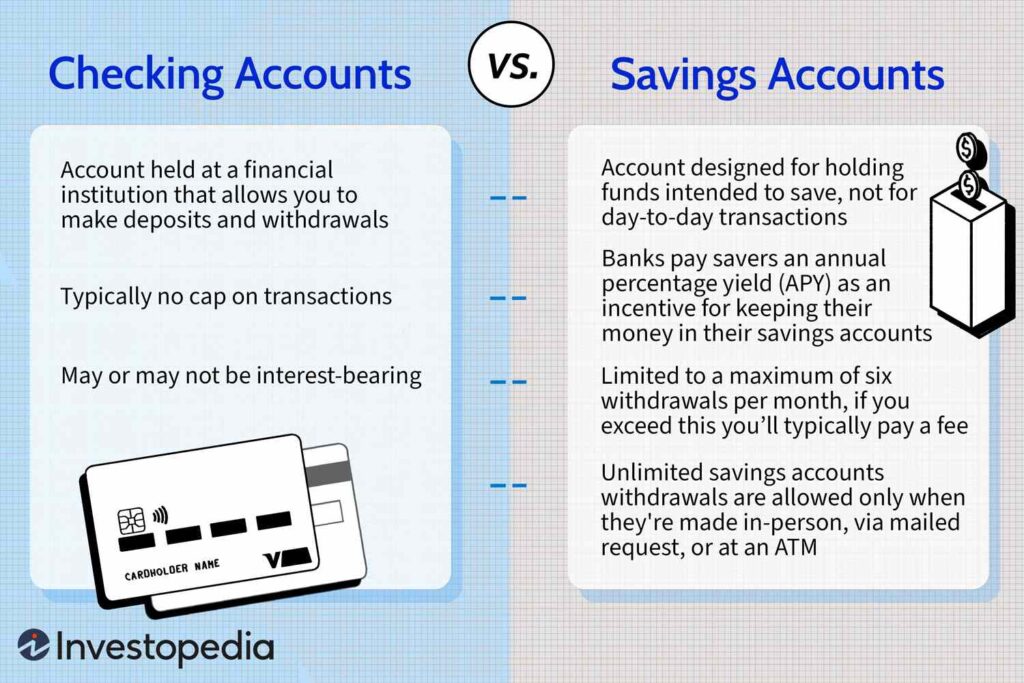

Savings payments can also hinder how regularly you can withdraw finances. Still, they commonly offer exceptional flexibility that’s perfect for building an emergency fund, saving for a quick-term cause like purchasing a vehicle or taking a vicinity excursion, or sincerely sweeping surplus coins you don’t need for your bank account so it can earn a chunk hobby.

Savings account

An economic financial savings account is a financial institution account at a retail monetary institution. Common capabilities embody restraint, extensive withdrawals, loss of cheques and linked debit card centers, restrained transfer options, and the inability to be overdrawn. Traditionally, transactions on monetary economic savings money owed were considerably recorded in a passbook and had been occasionally known as passbook financial savings debts, and monetary company statements were no longer furnished; however, such transactions are generally recorded electronically and handy online.

People deposit their budget in financial savings accounts for quite some motives, collectively with a stable region to hold their coins. Savings money owed normally pays interest nicely: almost all accrue compound interest over time. Several international places require savings money owed to be protected with the useful resource of deposit insurance, and some international locations offer a central authority to assure at least a part of the account stability.

There are many forms of savings debts, frequently serving specific purposes. These may additionally encompass bills for younger savers, accounts for retirees, Christmas membership money owed, investment accounts, and cash market money owed. Some financial savings payments furthermore have other unique necessities, such as at least a preliminary deposit, deposits made regularly, and notices of withdrawal.

Types of monetary financial savings money owed

Our variety of savings payments offer precise options for getting access to your money. These can encompass:

1. Health Savings Account

This form of monetary savings account allows you to set cash apart earlier than tax and might best be used for particular medical fees.

2. Kids Savings Account

These economic and financial savings debts are high-quality and can be had by youngsters and young adults (generally below the age of 18 or 21, depending on the country you are dwelling in). While some minors can open a financial savings account at some banks, they usually require a decide or jail parent as a joint account proprietor. Parents who want to switch property or deposit cash for their infant in their infant’s name most effectively do so within a custodial account. At Synchrony Bank, you could open a UGMA/UTMA custodial economic monetary savings account on behalf of your toddler.

- Instant-get right of entry to monetary economic savings bills

- You will pay in and take out coins each time you need to.

3.Limited-get right of entry to savings payments

You are often offering a higher interest fee than an instantaneous get-right of access to the account. You will be restrained from positive withdrawals in every account for a year to maintain that hobby charge.

4.Fixed-rate savings bills

A manner to shop a lump sum for a difficult and rapid amount of time. Your interest fee is constant, so it might stay put. For a few consistent rates of money owed, you may not only take out your cash after the period ends. For others, taking out coins is only possible by paying an early-get entry fee.

5. Traditional economic, monetary savings debts

A conventional financial savings account is largely a place to maintain your cash that earns interest.

This form of account lets you keep cash and earn hobby on any money you deposit into it, despite the reality that the prices it offers are low—typically around 0.01%. This economical, monetary savings money owed is supplied through traditional banks or credit unions. It commonly allows ordinary withdrawals with only a few guidelines (like a month-to-month withdrawal restriction set through the usage of the monetary organization or credit score union).

When evaluating financial savings charges, try using this calculator to look at what you can earn on a traditional economic financial savings account:

SAVINGS ACCOUNT – PROS AND CONSPROS

Savings Account gives higher safety and safety than cash.

There is liquidity; the quantity can be deposited and withdrawn whenever needed. It’s better to hold coins in gold, belongings, or the stock marketplace, which takes time, and cash must be taken out after some time.

You get to earn a hobby on idle/spare coins.

It is straightforward to carry out with the help of coins, cheques, ATM/Debit gambling, gambling, playing cards, and online banking.

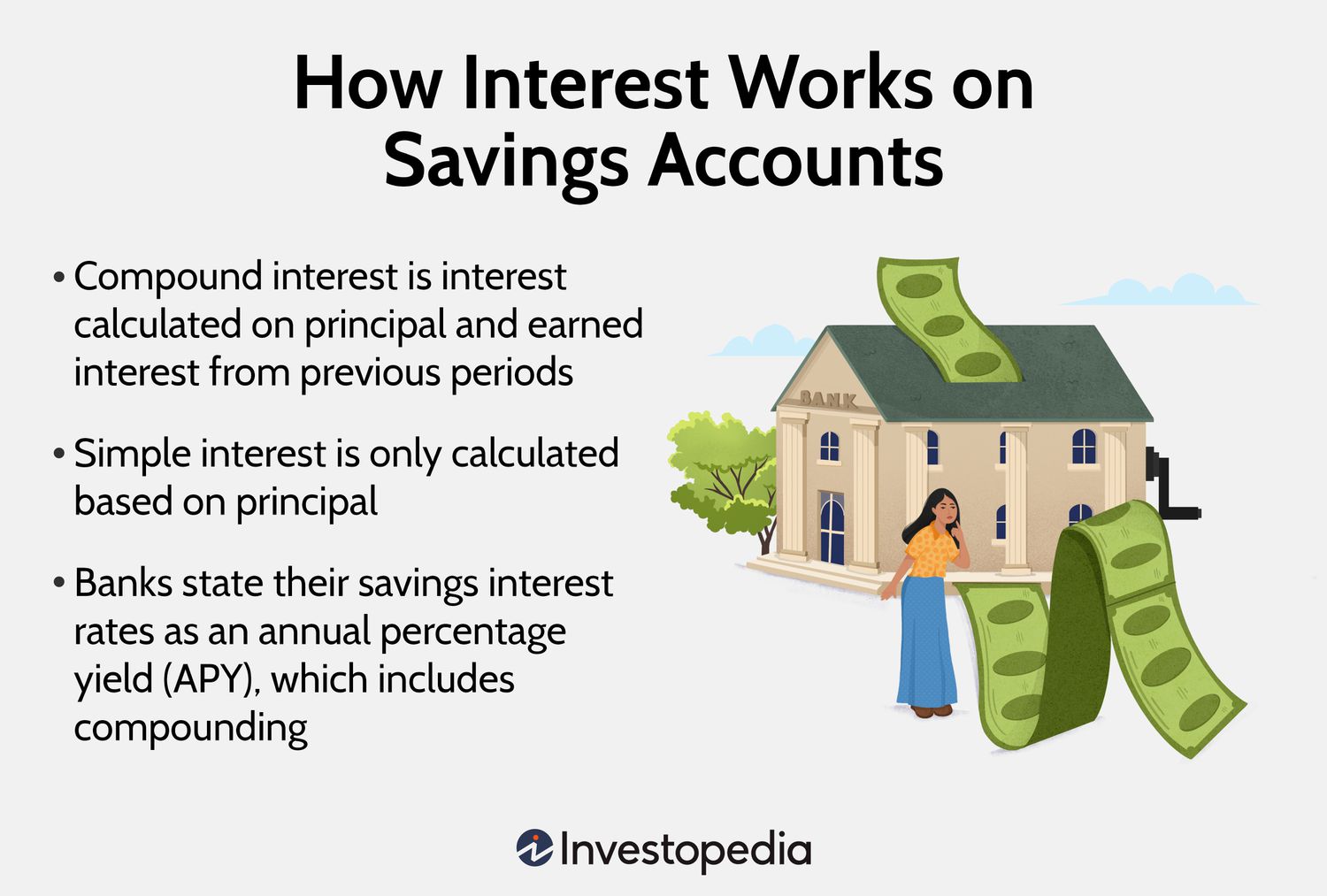

Interest on Savings Accounts

Most financial savings bills collect a small amount of interest. In special phrases, banks make small additions to their customers’ monthly savings. Nevertheless, the hobby rate relies on the country of the economic machine, in addition to the monetary organization’s competitiveness. While fees provided by using banks are generally slightly above inflation, there may be a minimum risk of loss because they are well assured. Also, a hobby is better than no interest.

To make comparisons of the numerous expenses at every one-of-a-kind bank, we are looking for recommendations from the annual percentage rate (APR) of every account collectively with different critical elements together with costs and required deposit amount.

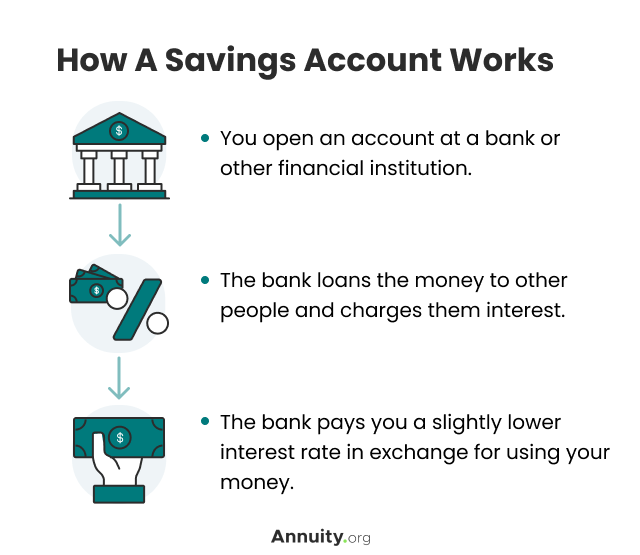

How Savings Accounts Work

Saving money owed is different from an economic organization. However, the approach commonly goes some aspects like this:

- Determine the monetary goals you want to obtain with an economic, financial savings account and determine where you want to park your cash.

- Open the account online, at a branch, or on a cellular phone.

- Deposit money to fund the account. In a few instances, a minimum deposit may be required.

- Earn interest at the cash you deposit and on the hobby you get to keep off. Money in your account is typically insured as much as a positive amount.

- Install automated deposits from a financial institution account or your electronically deposited paycheck to maximize your account.

- Deposit, withdraw, or switch coins simultaneously as you need to. You can try this online, at an economic enterprise department, at an ATM, or with a cell app, depending on the form of transaction.

Why you need a savings account

A savings account is a terrific region to hold coins for a later date, damage-unfastened everyday spending coins, as it offers safety, liquidity, and hobby-incomes capacity on your fee range. These bills are an outstanding vicinity for your emergency fund or financial, economic, and financial savings for shorter-term dreams, including a holiday or home restoration.

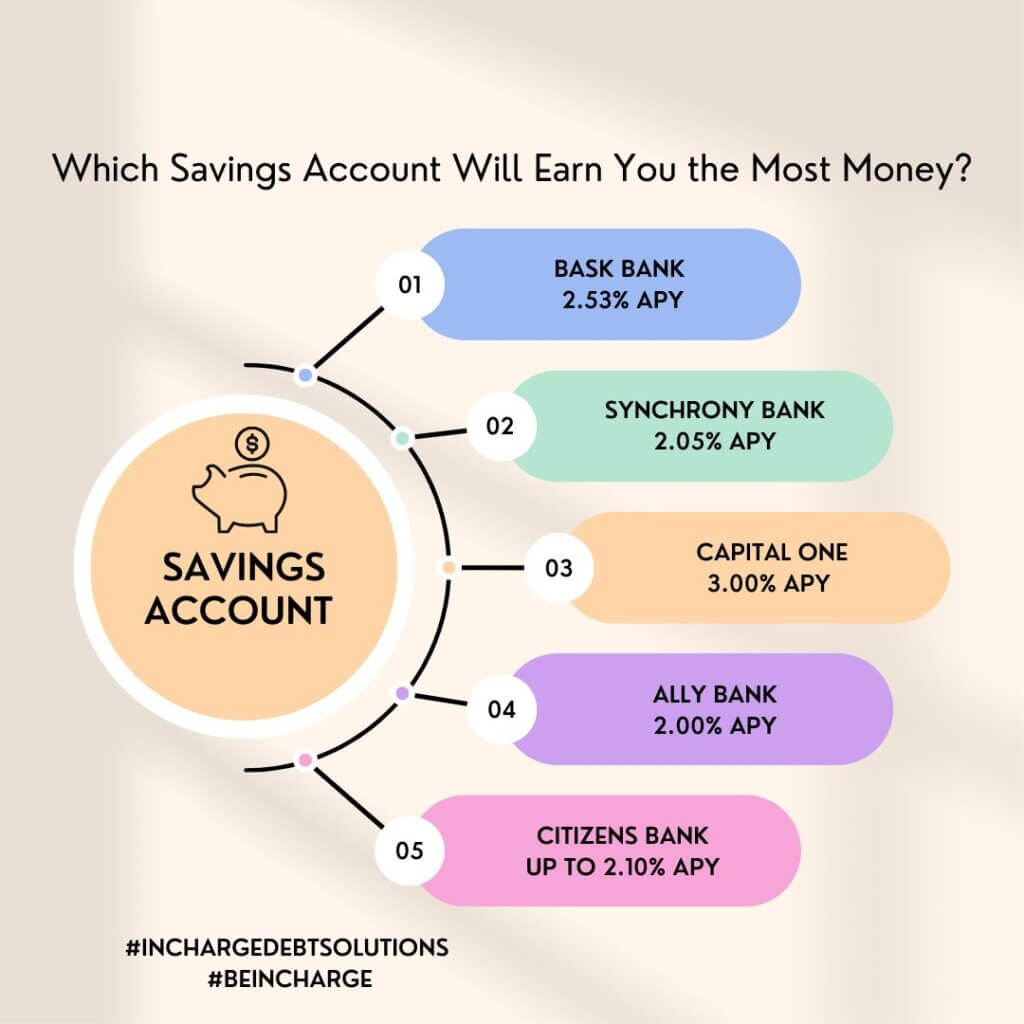

Beyond briefly getting the right to enter your coins while you need it, economic and financial savings payments regularly provide higher hobby costs than checking money owed. You could find some financial savings debts with better annual percent yields (APYs) than cash market bills. The common APY on economic and financial savings debts is virtually zero. Fifty-seven percent, but you can find out high-yield savings debts are paying more than 5 percent.

Finally, there are numerous possibilities to open a savings account with low charges. You can regularly discover smooth options to avoid pesky maintenance prices.

How to open a savings account

Many financial institutions allow you to open financial monetary savings accounts online. You also can open an economical financial savings account at a branch. When you open a savings account, you must expose your identity to various identities. For instance, you can use a reason pressure’s license and U.S. Passport.

Financial establishments have unique minimal establishing requirements, minimum balance necessities, and expenses. You’ll also need to test how the hobby rate and transaction limit artwork to better recognize your account.

Benefits of Opening a Savings Account

- There are several terrific reasons to maintain coins in a financial savings account, beginning with earning hobby. Savings debts can help you earn hobby to your cash without doing something extra. Although these aren’t pretty free coins, you still have to pay taxes on financial savings account interest profits. It’s far coins you may earn passively, truly by using the way of saving often.

- Savings money owed moreover provides greater liquidity and comfort than one-among-a-kind techniques to shop. For example, certificates of deposit, or CD, are another alternative for saving for quick- and prolonged-time period desires. And, in evaluating a few savings money owed, earning a higher APY with a CD account is feasible.

- But there’s an entice: CD debts are time deposits, which means that when you open one, you agree to relinquish your cash within the CD for a difficult and speedy period. While your coins are within the CD, they earn interest, but you usually need a trigger before it matures. An eco to get access to an economical financial savings account, as an alternative, normally permits up to 6 withdrawals in keeping per month without a penalty.

- Savings debts are also a stable way to set coins apart for destiny. While making funding coins is every one-of-a-kind way to help it broaden, putting cash into stocks or mutual finances can deliver risk. Saving money owed provides safety and a normal rate of return.

- Unlike investments, financial savings bills are typically insured through the Federal Deposit Insurance Corporation (FDIC)usage at banks and the National Credit Union Administration (NCUA) at credit score rating score unions. This insurance means that your savings are blanketed as a lot as sure limits even if your monetary organization or credit score rating union fails ($250,000 in line with the depositor, in line with account possession beauty).

Disadvantages of monetary savings bills

While financial savings debts have many advantages, there are a few potential downsides:

Low-interest charges: Traditional savings money owed usually offers mainly low-interest charges compared to distinctive investment alternatives. Even with excessive-yield savings bills, you may do better with a funding account in the long run.

Access limitations: Some financial institutions can also, despite the reality that restriction effective varieties of withdrawals and transfers from financial savings money owed to a restricted huge variety regular with month. And you commonly need help to write tests based on the money owed.

Minimum balance requirements: Some banks require you to maintain a minimal balance for your financial, economic, and financial savings account to avoid prices or earn the highest marketed interest fee.

Who can open a Savings Account?

Anybody can open a Savings Account. Any Indian countrywide can open a savings account, in my view, or any other Indian countrywide, with a utility shape and the desired KYC files. In reality, even a Hindu Undivided Family can open a Savings Account. At the same time as banks kingdom Indian citizenship as a name for beginning a Savings Bank Account, positive provisions have additionally been made for foreign nationals who stay within us for a long term because of the organization or top-notch paintings and need to make or get keep of bills; the ones people want to offer the considered necessary KYC documents alongside facet the utility form.

You can discover particular savings accounts with exceptional names and slightly special benefits and capabilities. Still, they will be all minor versions of the above-cited bills.