The money market account pays the same rates as savings accounts. They also have options for checking.

Most or all items featured on this page are made by our sponsors who pay us. The compensation affects the products we review and how they appear on the page.

But, it doesn’t impact our opinions. The opinions we express are entirely ours. Below is a list of our associates and the way we earn profits.

Understanding the Money Market

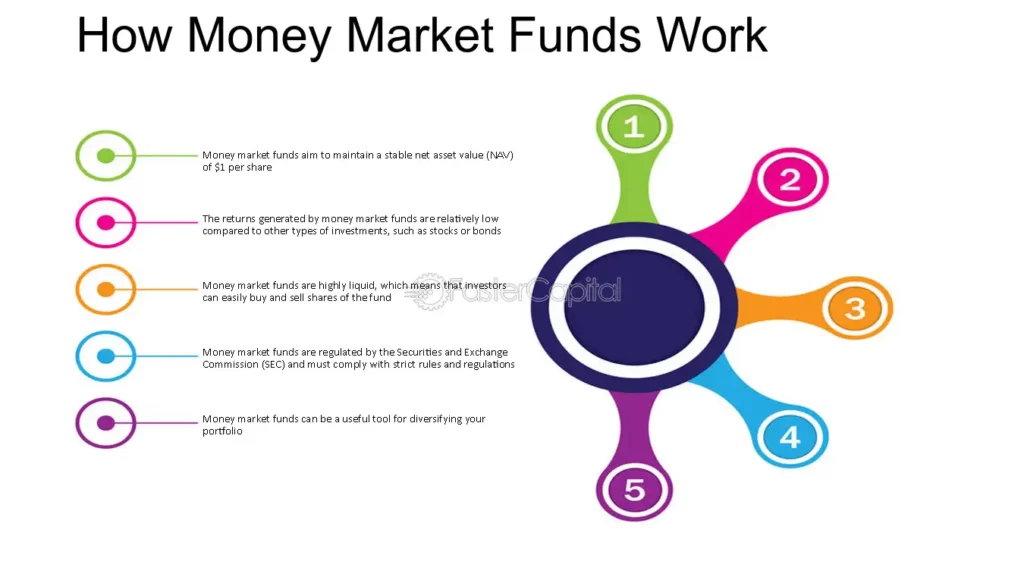

The money market is one of the foundations of the international financial system. It is a place where overnight swaps involve huge sums of money between banks and governments like the U.S. government. A majority of the financial transactions in the market involve wholesale transactions taking place between banks as well as businesses.

Participating institutions in the market for money include banks that loan money to each other and also big corporations in the euro currency or time deposit markets. Some businesses make money by trading commercial paper in the market. This paper is then purchased by other firms or funds and customers who invest in bank CDs for a space to keep their cash in the short term. A few of these wholesale transactions ultimately end up in customers’ pockets in the form of mutual funds and other investment options.

Money Market Accounts Benefits

Here is a quick summary of the most common advantages of the money market account:

1. Rates of interest that are competitive

The majority of money market accounts offer greater rates of interest as compared to other deposits. Online banks typically have greater rates of interest than traditional brick-and-mortar banks. Consider switching banks if your current bank offers low rates.

2. Convenience

Accounts with a money market make saving funds in an interest-bearing bank account simple, and you can use it whenever you need to. With unlimited deposit options like this one, it is possible to deposit additional funds into your money market account at any time, even in smaller amounts. You can then withdraw it whenever you need to, subject to the limits of your bank. Automatic savings each payday is a great way to grow the savings account in your money market.

How can you get the highest interest rates on money markets?

The interest rates for savings accounts for money have increased dramatically over the past couple of years due largely toforts to tackle the rise in inflation. The Fed has raised its federal fund’s benchmark rate from close to zero by the beginning of 2022 to over five per cent, and the interest rates for savings vehicles like money market accounts, CDs, and savings accounts have also increased.

Do the current rates hold? The pace of inflation fell dramatically between 2023 and 2023. It’s a good thing for the economy; it’s not good news. There’s a lower chance that savers will see more rate hikes this year. Most Fed observers believe the central bank will slowly cut rates by 2024.

The types of accounts for the money market

Similar to savings accounts, they are available in two varieties of accounts for money markets: traditional and high-yielding. Traditional accounts for the money market offer very low-interest rates, but they’re better than the majority of traditional savings accounts.

On the other hand, high-yielding money market accounts provide interest rates higher than those of conventional savings accounts. However, they could offer better rates than other high-yield savings accounts.

1. Find the perfect money market account that is right for you.

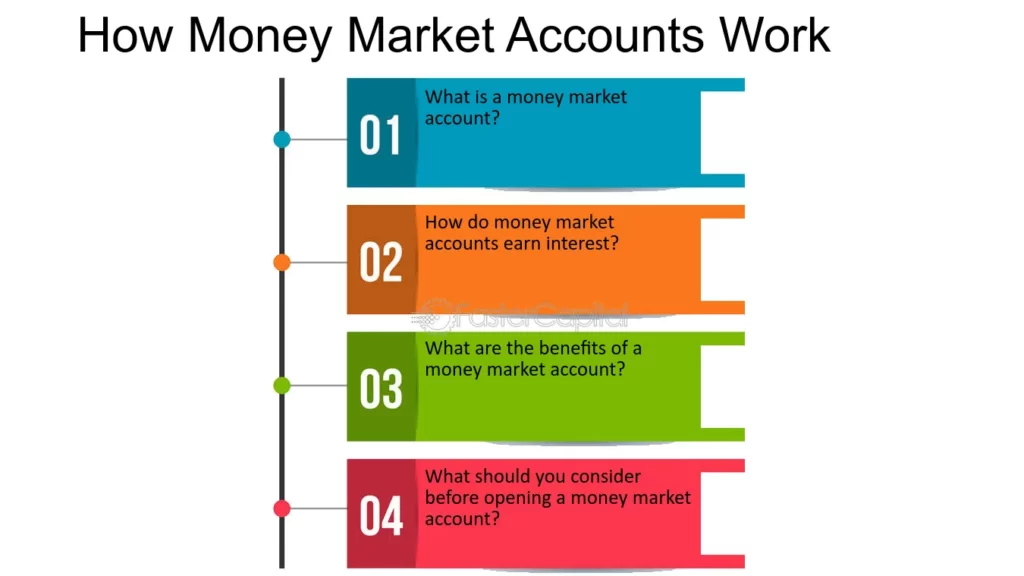

In the process of looking for a cash market account, you should consider several important things to take a be aware of:

Interest rates: You’d like to ensure that your cash grows the fastest way possible. Therefore, you must choose market accounts with greater annual per cent rates (APYs). The term APY is used to describe the amount of amount of interest that you can earn from the account for a year. The slight difference in percentage might not be a big deal; however, it’ll add to a lot over time.

Insurance: The FDIC or NCUA generally insures money-market accounts up to $250,000 by federally insured banks and credit unions. But, it is important to confirm the insurance coverage before opening a bank account.

The minimum requirements for many banks need a minimum balance and the daily balance of your account. It’s crucial to locate an account for the money market that meets the requirements you are confident you will meet.

Fees: Search for the money market account with the lowest fees possible. More charges, like fees for maintenance or service, could negate any account benefit.

Accessibility: If you require a moderate amount of access to your cash, consider looking for a money market account with the option of a debit card or ATM check, a card with fewer transaction limits.

Transaction Limits for Money Market Accounts

Typically, money market accounts are restricted to six withdrawals or transfers each month (or statements cycle) due to Regulation D. Limited transactions could be:

Transfers of funds from one account to another

But, to address the COVID-19 crisis and ease the process for customers to access their savings, In April 2020, the Federal Reserve announced an interim final rule suspending the Regulation D limit on monthly cash withdrawals from money market accounts. However, banks and credit unions could charge a fee if the normal monthly limit exceeds.

Money market accounts pros and cons market accounts.

Advantages

- There is a chance to earn interest. At present, the top money market accounts offer 4.15 to 5 per cent annual per cent yield (APY), a huge improvement from a year ago.

- You can be assured that your cash is protected up to $250,000 for account owners when you have a credit union or bank banking account.

- You can access cash in your account with a debit or physical check.

Disadvantages

- Deposit requirements that are large Accounts in the money market require more deposits than traditional savings accounts to establish the account or earn the best APR.

- Lower yields compared to other bank products. For example, certificates of deposit could offer a higher than competitive rate. Investors comfortable accepting a higher risk may benefit from higher returns on bonds and stocks.

- Limitations on withdrawals: Although you may create checks or utilize debit cards to withdraw money from the money market account, you’ll have to adhere to certain restrictions as these accounts weren’t intended for transactional transactions.

A history of MMAs and trends in rate over the last decade

Market accounts are generally more expensive than regular savings accounts; however, these rates have been relatively low in the past decade. As of January 2013, the average rate of savings accounts for money was 0.11 per cent annual per cent yield (APY), a decrease of 0.11%. Rates declined in the following four years.

Rates began to increase in 2018, with a maximum of 0.19 per cent APY in 2019. However, rates fell beginning in 2020. The year 2022 saw it was the year that the Federal Reserve started raising interest rates to counter inflation, leading to higher interest rates on money market accounts. In the year 2022’s final year, interest rates had reached 0.38 per cent of APY. And at the end of June 2023, rates were at 0.59% of APY.

Rates can fluctuate frequently depending on market conditions, but they also depend on the size of the cash market accounts. The greater your account’s balance, the higher the interest rate you can receive.

Who is the right person to open a money market account?

The money market accounts aren’t intended to help you pay regular expenditures like groceries, rent or gym membership fees. The best MMAs can be a great option to help you save (and gain) cash in the short term. Put your money in an account in a money market for the emergency fund, getaway, or even a large buy — a brand perhaps a brand new car?

To save for the long term or earn higher returns, talk to an advisor in the field to determine the most suitable investment strategy to meet your needs. If you cannot satisfy your bank’s minimum balance requirements, you can shop for alternatives or consider opening an ordinary savings or checking account.

Are the money market accounts FDIC covered?

The money market accounts are categorized as deposit accounts. Therefore, each MMA account you open through the bank will be covered under FDIC insurance. FDIC insurance will cover as much as $250,000 per account and per bank and account kind.

Suppose you’re the sole holder of a savings or chequebook and money market account in a single financial institution. In that case, the FDIC covers the total amount of the accounts for a maximum of $250,000 since they’re all covered under the FDIC’s “single accounts” class. For greater coverage, it is possible to create an account at a different bank or a new kind of account, such as a joint one. Certain types of accounts, including Wealthfront cash account Wealthfront cash account will automatically do this to expand the FDIC protection.

Credit union MMAs are covered by The National Credit Union Administration (NCUA). This insurance is the same as the FDIC offers and covers the amount of $250,000 per account, credited per.

How Does a Money Market Account Work?

A money market account combines many of the most beneficial advantages of savings and a checking account. Although interest rates and account conditions differ from one institution to the next, here are the top features likely to be encountered in MMAs:

- They are available at many banks and credit unions.

- A higher interest rate over traditional savings accounts

- Easy-to-use tools for transactions such as checks as well as debit cards

- Easy to open and use

- There are many minimum balance requirements (and If you don’t comply, you’ll be charged costs)

- Some also have limits on transactions (for example, 6 check or debit transactions each month)

Bottom line

Although money market accounts and savings accounts are subject to withdrawal restrictions, market accounts come with a couple of variations that provide greater flexibility regarding access to funds. They typically come with chequebooks and debit cards.

These accounts typically feature high APRs. However, they could be more expensive regarding fees and minimal requirements than checking and savings accounts. It would help if you looked at various accounts for the money market for the most rates and fees.

Freelance journalist Sarah Sharkey contributed to a previously published version of this article.